Software subscriptions. Office rent. Employee benefits. Is your business money vanishing into thin air? A business budget template puts you back in control by tracking every dollar you spend.

Whether you‘re launching a startup or scaling an enterprise, you’ll spot exactly where to cut costs and where to invest for growth.

In my roles, I created budgets for whole projects and smaller writing projects.

While organizing the numbers may sound difficult, I find business budget templates make the process simple. Plus, there are thousands of business budget templates to choose from.

In this article, I share seven budget templates to help organize your finances. But first, you’ll learn about different types of business budgets and how to create one.

What is a business budget?

A business budget is a spending plan that estimates the revenue and expenses of a business for a period of time, typically monthly, quarterly, or yearly. A business budget follows a set template — you fill it in with estimated revenues and any recurring or expected business expenses.

For example, say your business is planning a website redesign. You’d need to break down the costs by category: software, content and design, testing, and more. Having a clear breakdown will help you estimate how much each category will cost and compare it with the actual costs.

Types of Business Budgets

Business budgets aren’t one size fits all. In fact, there are many types of budgets that serve various purposes. Let’s dive into some commonly used budgets.

Master Budget

A master budget brings together all the individual budgets from different parts of your company into a consolidated plan. It covers everything from sales and production to marketing and finances.

This budget includes details like projected revenues, expenses, and profitability for each department or business unit. It also considers important financial aspects, like cash flow and capital expenditures. The budget even creates a balance sheet to show the organization’s financial position.

The master budget acts as a guide for decision-making, helps with strategic planning, and gives a clear picture of your company’s overall financial health and performance. It ties everything together and helps the organization move in the right direction.

For example, imagine you run a software company. Your master budget would combine the following:

- Sales team budget ($100,000 for salaries and commissions).

- Marketing budget ($50,000 for ads and campaigns).

- Development budget ($200,000 for engineering talent).

- Operations budget ($75,000 for office space and utilities).

This merged view shows you’ll need $425,000 to run all departments for the year. You can then compare this against your projected revenue of $600,000 to see if your business plan is viable. The master budget helps you spot potential issues (like overspending in marketing) before they become problems and identify opportunities (like having enough profit to hire another developer).

Pro tip: From my experience managing various business budgets, I recommend starting with a master budget and then creating more specific budgets as your needs grow.

Operating Budget

Your operating budget shows how much money your company expects to make and spend during a specific period, usually a year. It predicts your business’s revenue and outlines expenses, like salaries, rent, bills, and other operational costs.

By comparing your actual expenses and revenue to the budgeted amounts, your company can see how it’s performing and make adjustments if needed. It keeps things in check, allowing your business to make wise financial decisions and stay on track with its goals.

For example, a small marketing agency’s monthly operating budget may look like this.

- Expected Income: $50,000 from client retainers

- Regular Expenses:

- Staff salaries: $25,000

- Office rent: $3,000

- Software subscriptions: $1,500

- Utilities: $500

- Marketing: $2,000

By tracking these numbers monthly, you can spot trends — like if client revenue drops in summer months or if software costs are creeping up — and adjust your spending before issues arise.

Cash Budget

A cash budget estimates the cash inflows and outflows of your business over a specific period, typically a month, quarter, or year. It provides a detailed projection of cash sources and uses, including revenue, expenses, and financing activities.

The cash budget helps you effectively manage your cash flow, plan for cash shortages or surpluses, evaluate the need for external financing, and make informed decisions about resource allocation.

By using a cash budget, your business can ensure it has enough cash on hand to meet its financial obligations, navigate fluctuations, and seize growth opportunities.

For example, imagine you run an e-commerce business.

- Starting Cash: $20,000

- Expected Cash In:

- Product sales: $15,000

- Affiliate revenue: $2,000

- Expected Cash Out:

- Inventory restock: $8,000

- Shipping costs: $3,000

- Staff payroll: $5,000

- Marketing: $2,000

This shows you’ll end with $19,000 in cash. But if your inventory payment is due before customer payments arrive, you may still face a temporary cash shortage. A cash budget helps you spot and plan for these timing gaps.

Static Budget

A static budget is a financial plan that remains unchanged, regardless of actual sales or production volumes.

This budget is typically created at the beginning of a budget period and doesn’t account for any fluctuations or changes in business conditions. It also assumes that all variables, such as sales, expenses, and production levels, will remain the same throughout the budget period.

While a static budget provides a baseline for comparison, it may not be realistic for businesses with fluctuating sales volumes or variable expenses.

For example, if you run a consulting business, your annual static budget may allocate $60,000 for advertising — that’s $5,000 per month. Even if you have an amazing Q1 and could benefit from increased ad spend or a slow Q3 where you should cut back, a static budget keeps that $5,000 monthly allocation unchanged. While this makes planning simple, it can limit your ability to adapt to changing business conditions.

Departmental Budget

A departmental budget focuses on the financial aspects of a specific department within your company, such as sales, marketing, or human resources.

When creating a departmental budget, you may look at revenue sources like departmental sales, grants, and other sources of income. On the expense side, you consider costs, such as salaries, supplies, equipment, and any other expenses unique to that department.

The goal of a departmental budget is to help the department manage its finances wisely. It acts as a guide for making decisions and allocating resources effectively. By comparing the actual numbers to the budgeted amounts, department heads can see if they’re on track or if adjustments need to be made.

Let‘s look at an example of a marketing department’s quarterly budget.

- Revenue Goals:

- Lead generation: $100,000

- Event sponsorships: $25,000

- Department Expenses:

- Team salaries: $75,000

- Content creation: $15,000

- Ad campaigns: $20,000

- Marketing tools: $5,000

This detailed breakdown helps the marketing director track performance against goals and adjust tactics — like shifting money from underperforming ad campaigns to successful content creation — without affecting other departments’ budgets.

Capital Budget

A capital budget is all about planning for big investments in the long term. It focuses on deciding where to spend money on things like upgrading equipment, maintaining facilities, developing new products, and hiring new employees.

The budget looks at the costs of buying new stuff, upgrading existing things, and even considers depreciation, which is when something loses value over time. It also considers the return on investment, like how much money these investments might bring in or how they could save costs in the future.

The budget also looks at different ways to finance these investments, whether through loans, leases, or other options. It’s all about making smart decisions for the future, evaluating cash flow, and choosing investments that will help the company grow and succeed.

For example, a growing tech company might create a 5-year capital budget like this.

- Year 1: $200,000 for new office space

- Year 2: $150,000 for server infrastructure

- Year 3: $300,000 for custom software development

- Year 4: $250,000 for expansion to second location

- Year 5: $100,000 for equipment upgrades

Each investment is evaluated based on ROI and depreciation. The company might decide to lease the office space (lower upfront cost) but buy the servers outright (better long-term value).

Labor Budget

A labor budget helps you plan and manage the costs related to your employees. It involves figuring out how much your business will spend on wages, salaries, benefits, and other labor-related expenses.

To create a labor budget, consider how much work needs to be done, how many folks you’ll need to get it done, and how much it’ll all cost. This can help your business forecast and control labor-related expenses and ensure adequate staffing levels.

For example, a small design agency’s monthly labor budget might look like this.

- Full-time Staff:

- 2 Senior Designers ($90,000/year each)

- 3 Junior Designers ($60,000/year each)

- 1 Project Manager ($75,000/year)

- Benefits & Taxes (30% of salaries): $121,500/year

- Freelance Budget: $5,000/month

- Training & Development: $2,000/month

This helps the agency plan hiring needs and ensure they have enough billable hours to cover labor costs.

Project Budget

A project budget is a financial plan for a specific project.

Let’s say you have an exciting new project you want to tackle. A project budget showst how much money you’ll need and how to allocate. It covers everything from personnel to equipment and materials — basically, anything you’ll need to make the project happen.

By creating a project budget, you can make sure the project is doable from a financial standpoint. It tracks how much you planned to spend versus how much you actually spend as you go along.

That way, you have a clear idea of whether you’re staying within budget or if there are any financial challenges that need attention.

For example, here’s a budget for a website redesign project:

- Design Phase: $20,000

- UI/UX designer: $12,000

- Brand consultant: $8,000

- Development Phase: $45,000

- Frontend developer: $25,000

- Backend developer: $20,000

- Content & Testing: $15,000

- Content writer: $8,000

- QA testing: $7,000

- Buffer for revisions (10%): $8,000

- Total project budget: $88,000 over 3 months

This detailed breakdown helps track spending at each phase and ensures you have enough buffer for unexpected changes.

How to Create a Business Budget

While creating a business budget can be straightforward, the process may be more complex for larger companies with multiple revenue streams and expenses.

No matter the size of your business, here are the basic steps to creating a business budget.

1. Gather financial data.

Before creating a business budget, gather insights from your past financial data. By looking at income statements, expense reports, and sales data, you can spot trends, learn from past experiences, and see where you can improve.

Going through your financial history paints an accurate picture of your income and expenses. So, when you create your budget, you can set achievable targets and make sure your estimates match what’s been happening in your business.

Besides past financials, consider new expenses. For instance, if your business wants to try a new marketing channel, document your goals for that channel. Afterward, walk backward to figure out how much you need to achieve those goals and include it in your budget.

Pro tip: I always keep my previous year’s financial data in a separate spreadsheet. This makes it easier to spot trends and helps prevent accidental overwrites.

2. Find a template or make a spreadsheet.

There are many free or paid budget templates online. You can start with an existing budget template. We list a few helpful templates below.

You may also opt to make a spreadsheet with custom rows and columns based on your business.

3. Fill in revenues.

Once you have your template, start by listing all the sources of your business’ income. A budget plans for the future, so you’ll need to forecast revenue streams based on previous months or years.

For a new small business budget, you’ll rely on your market research to estimate early revenue for your company. If you’re trying out new channels, consider using industry benchmarks to gauge the expected revenue.

When you estimate your revenue, you’re figuring out how much money you have to work with. This helps you decide where to allocate your resources and which expenses you can fund.

4. Subtract fixed costs for the time period.

Fixed costs are the recurring costs you have each month, quarter, or year. Examples include insurance, rent for office space, website hosting, and internet. Remember, fixed costs stay relatively stable, regardless of changes in business activity. Even if your sales decrease or production slows down, these costs remain the same.

Note that fixed costs can change over the long term, such as when renegotiating lease agreements or adjusting employee salaries.

5. Consider variable costs.

Variable costs will change from time to time. Unlike fixed costs, variable costs increase or decrease as the level of production or sales changes.

Examples include raw materials needed to manufacture your products, packaging and shipping costs, utility bills, advertising costs, office supplies, and new software or technology.

You may always need to pay some variable costs, like utility bills. However, you can shift how much you spend toward other expenses, like advertising costs, when you have a lower-than-average estimated income.

6. Set aside time for business budget planning.

Unexpected expenses might come up, or you might want to save to expand your business. Either way, review your budget after including all expenses, fixed costs, and variable costs.

Once completed, determine how much money you can save. It’s wise to create two or more savings accounts to prevent overspending. For instance, use one for emergencies and the other to drive business growth.

7. Conduct budget reviews.

Every budget requires periodic reviews. Regular reviews let you know what’s working and respond to changes in your financial outlook.

When reviewing your budget, compare your estimated budget to your actual spend. This lets you know how to make better revenue and expense projections.

There’s no rule stating when you should conduct your budget review. However, I recommend doing it monthly, quarterly, and yearly.

- Monthly reviews: Check your estimated versus actual spend. Look for items whose actual spend surpasses the estimated cost. Consider cost-cutting measures for such items when forecasting your expenses for the next month.

- Quarterly reviews: Use this review to identify month-over-month budget estimates and actual spend for three months. Use the insights to determine what you should spend less or more on and forecast better for the next quarter.

- Yearly reviews: This review lets you assess your projections for the year. If they were accurate, double down on it. If otherwise, reflect on what didn’t work and use what you’ve learned to make better long-term financial projections for the next year.

How to Manage a Business Budget

Smart budget management separates thriving businesses from struggling ones. The most successful companies follow three key strategies to stay financially healthy.

1. Set clear financial goals and limits.

First, establish specific revenue targets for each month, quarter, and year. Based on these targets, assign strict spending limits to each department.

Next, protect your business by setting aside emergency funds — most experts recommend three to six months of operating expenses.

Finally, create separate budgets to balance daily operations with long-term growth initiatives.

2. Track every dollar (daily or weekly).

Once your goals are set, make budget check-ins part of your daily routine. During these reviews, carefully compare actual spending against your projections.

To maintain accuracy, record every expense immediately — yes, even that $4 coffee run. Better yet, use software to automatically capture and categorize transactions, which helps prevent any unwelcome surprises at month’s end.

3. Analyze and adjust monthly.

Review your monthly performance to spot patterns in revenue and spending. If you find unnecessary expenses, cut them immediately. Meanwhile, look for opportunities to secure better deals on regular purchases. Then, use these insights to adjust department budgets based on performance.

Most importantly, when you come in under budget, make smart choices about saving that extra money or reinvesting it in growth opportunities.

Why is a budget important for a business?

A business budget is your financial roadmap, showing where you are and where you can afford to go. Your budget prevents financial surprises by tracking every dollar coming in and going out. This clear visibility helps you spot and fix cash flow problems before they damage your business.

With this financial clarity, you can turn gut decisions into data-driven choices. For instance, when considering a new hire or a software upgrade, your budget shows when you can afford these investments — and when you should wait.

Most importantly, consistent budgeting builds long-term security. By planning your savings, you’ll have cash reserves ready for emergencies and opportunities, keeping your business resilient and ready for growth.

Best Free Business Budget Templates

After testing dozens of budget templates over the years, I’ve found these seven to be the most user-friendly and adaptable for different business needs.

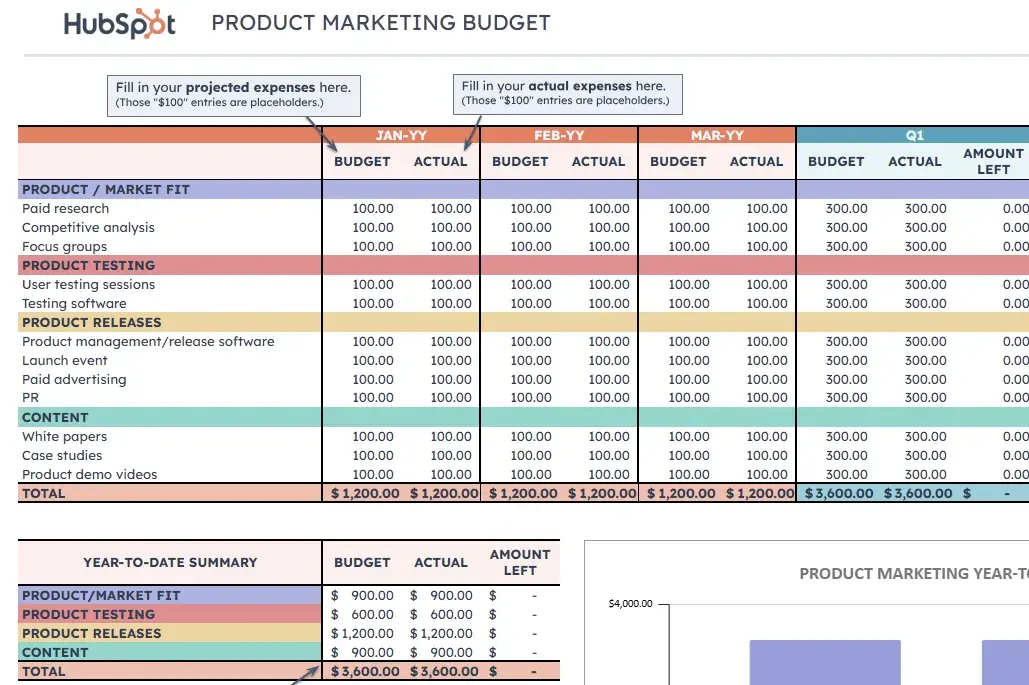

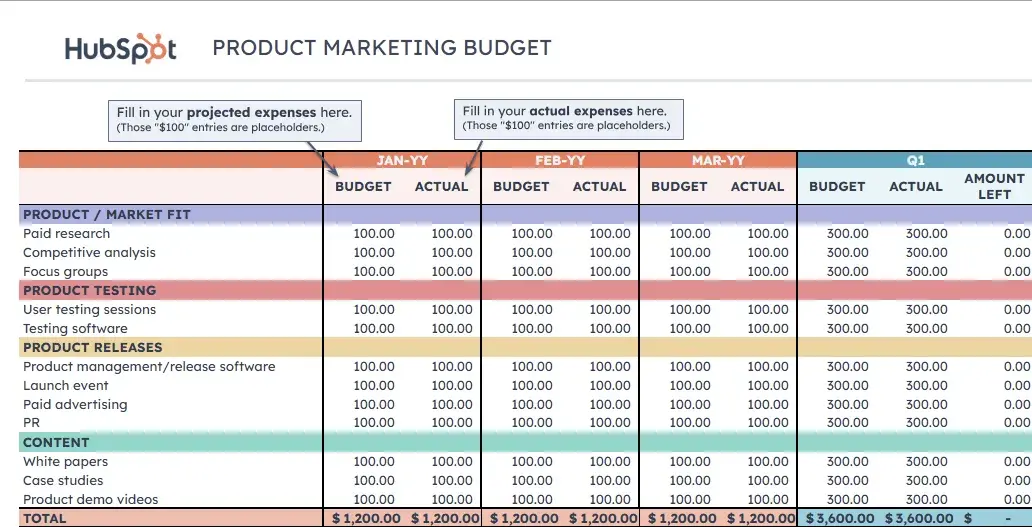

1. Marketing Budget Template

Best for: Companies executing multiple initiatives across several marketing channels

Knowing how to manage a marketing budget can be a challenge, but with helpful free templates like this marketing budget template bundle, you can track everything from advertising expenses to events and more.

I like this bundle because it’s comprehensive and has eight free business budget templates. There are templates for:

- Branding and creative budget.

- Product marketing budget.

- Paid advertising budget.

- Public relations budget.

- Web design budget.

- Content budget.

- Event budget.

The master budget template brings everything together and serves as your single source of truth. It consolidates the different budgets into a massive, company-wide budget sheet. Having a specific template for each initiative helps teams track spending and plan for growth.

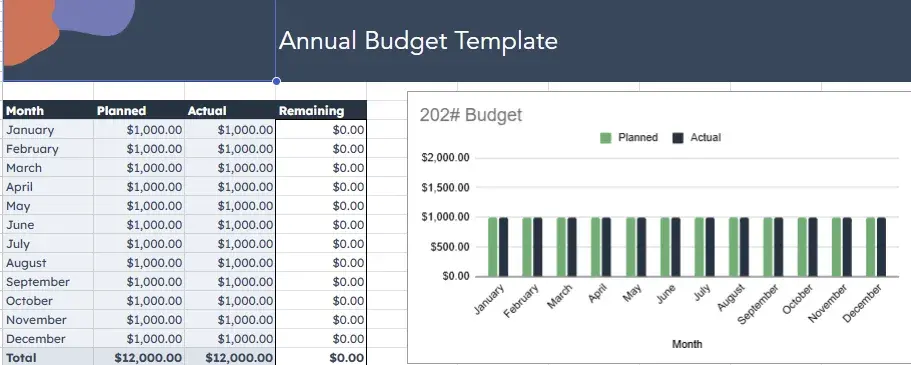

2. Project Budget Template

Best for: In-house teams seeking buy-in for complex projects

Every new project comes with expenses. This free business budget template will help your team calculate the total cost once you enter your labor, material, and fixed costs. You can easily spot if you’re over budget midway through a project so you can adjust.

This template is especially useful for small companies that are reporting budgets to clients and for in-house teams getting buy-in for complex projects.

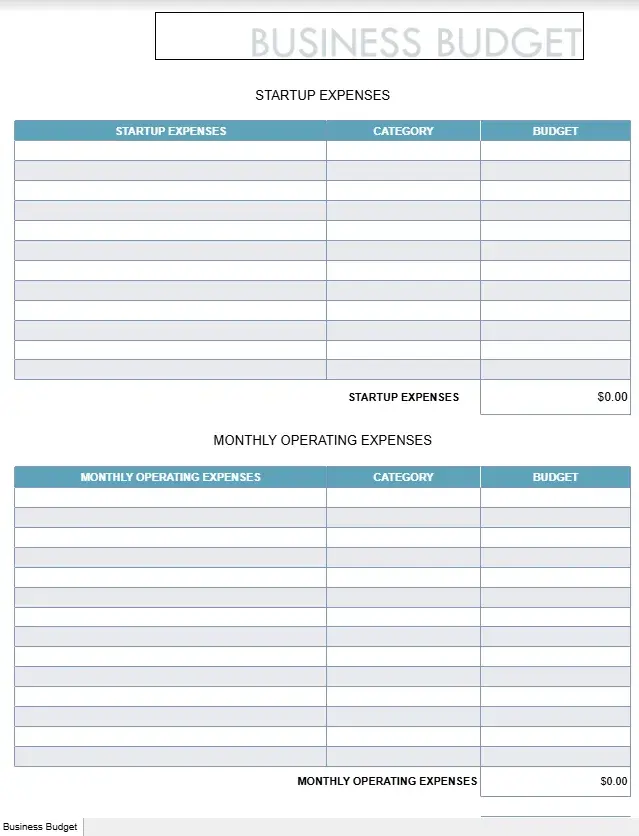

3. Free Business Budget Template

Best for: Businesses of all types executing a minimal number of initiatives

Sometimes, you may need to document a simple budget for a few initiatives. In such cases, this free business budget template, which works in Google Sheets and Excel, may be ideal. I like the idea of Google Sheets because it lets others collaborate and comment on the budget.

These business budget templates feature cells for entering your expenses, category, and budget. Afterward, the spreadsheet uses the data to create your total estimated budget.

4. Content Budget Template

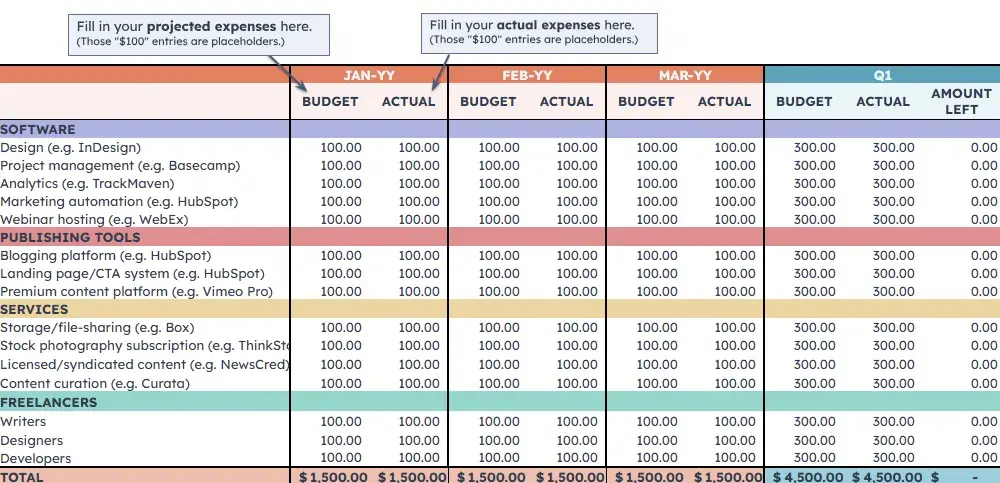

Best for: Content marketing teams and agencies managing multiple content types

This template helps you plan and track expenses across your content marketing initiatives. From blog posts to videos, you’ll know exactly where your content budget goes.

The template includes dedicated sections for:

- Freelancer payments.

- Services (e.g., storage, stock photos, etc.).

- Publishing tools (e.g., HubSpot).

- Software (e.g., Basecampe and Indesign).

Breaking down content costs this way helps you identify which content types deliver the best ROI and where you might be overspending.

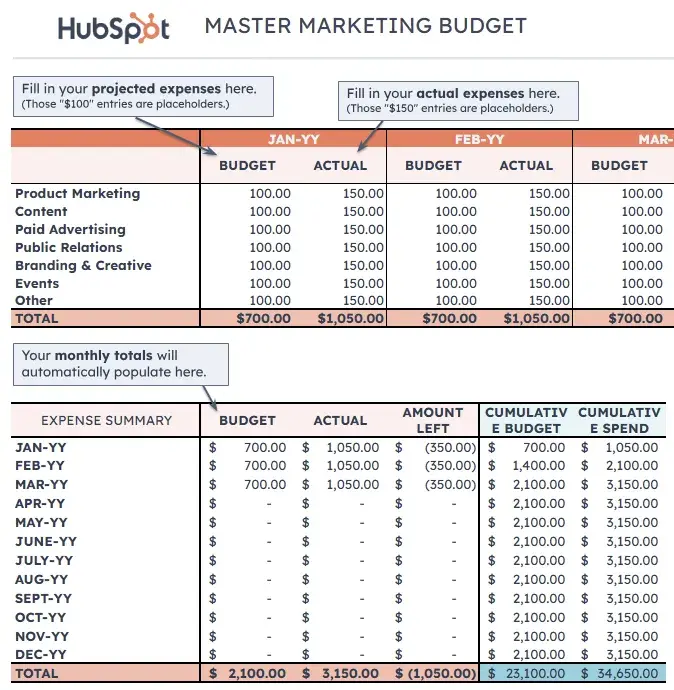

5. Master Marketing Budget Template

Best for: Marketing directors managing multiple campaigns and channels

This comprehensive template brings all your marketing expenses into one view. It’s perfect for businesses running multiple campaigns across different channels.

The master marketing budget template helps you:

- Track spending across all marketing initiatives.

- Compare channel performance.

- Adjust budgets based on ROI.

- Plan future marketing investments.

This big-picture view of your marketing spend helps you make smarter decisions about budget allocation across channels.

6. Paid Advertising Budget Template

Best for: Digital marketers managing multiple ad platforms

Keep track of your advertising spend across Google Ads, social media, and other platforms. This template helps you optimize your ad spend and improve ROI.

Key features include:

- Platform-specific budget tracking.

- Campaign performance metrics.

- ROI calculations.

- Monthly and quarterly comparisons.

With these metrics at hand, you can quickly spot which ad platforms are worth your investment and which need adjustment.

7. Event Budget Template

Best for: Event planners and marketing teams organizing business events

Whether you’re planning a product launch or industry conference, this template helps you manage every event expense.

It tracks costs for:

- Venue and equipment.

- Catering and refreshments.

- Speaker fees.

- Marketing materials.

- Staff.

- Promotion.

- Miscellaneous items (e.g., name tags and swag bags).

It also includes a visual pie chart to see how your money is split, making it easy to spot where your event budget is going and where you might need to adjust.

How to Use a Business Budget Template

Getting started with a business budget template is straightforward when you follow these key steps.

1. Set up your template.

Begin by downloading your chosen template and taking time to understand its structure. You’ll notice sample data showing how the template works — this is your guide for proper data entry.

Remove these example figures, but be careful to preserve the underlying formulas that make the template work. Most templates include multiple sheets or sections, so familiarize yourself with how they connect before adding your data.

Pro tip: I always make a backup copy of any template before removing example data. This gives me a clean reference point if I need to check the original formulas later.

2. Input your income sources.

Start with your revenue streams. Enter your primary income first, such as product sales or service fees. Then, add secondary income, such as affiliate revenue or advertising income.

Be conservative with your estimates — it’s better to underestimate income slightly than to overproject and fall short. Make sure to document any seasonal patterns or irregular income so you can plan accordingly.

3. Add your expenses.

Tackle your expenses methodically, starting with fixed costs like rent and salaries. These are easiest to project since they rarely change.

Next, add variable expenses, such as supplies and marketing costs. But pay special attention to expenses that fluctuate seasonally. And don’t forget to include irregular expenses like annual software subscriptions or quarterly tax payments.

The more detailed you are here, the more accurate your budget will be.

4. Review and adjust monthly.

Monthly reviews keep your budget accurate and useful. So, set aside time each month to compare your projected figures against actual spending and income.

Look for patterns and investigate any significant variances. Then, use this information to refine next month’s projections. If you consistently over or underestimate certain categories, adjust your future projections accordingly.

5. Use the analytics features.

Most templates include built-in analytics that reveal important insights about your business. Study the graphs and charts to understand spending patterns and identify potential problems before they become serious.

Also, pay attention to trends in your cash flow and look for opportunities to reduce costs or increase efficiency. These visual tools can help you explain budget decisions to stakeholders or team members.

6. Keep recording.

Document everything as you go — small expenses add up quickly and are easy to forget. Create a simple system for storing receipts and recording transactions immediately.

When you spot unusual expenses or windfalls, add notes explaining them. This context becomes invaluable during future planning. Review your budget categories quarterly to ensure they still match your business needs. Don’t hesitate to adjust them if your business model changes.

Create a Business Budget to Help Your Company Grow

Creating your first business budget is simpler than you might think. Pick a template that matches your business needs, add your numbers, and you’re on your way to better financial decisions.

The hardest part is getting started — and these business budget templates make that easy. Choose one and take the first step toward growing your business.

Editor’s note: This post was originally published in September 2021 and has been updated for comprehensiveness.

![]()